“Rich Dad’s Cashflow Quadrant” audiobook by Robert T. Kiyosaki explains the four types of income earners. It offers insights on achieving financial freedom.

Robert T. Kiyosaki’s “Rich Dad’s Cashflow Quadrant” is a transformative guide for those seeking financial independence. Kiyosaki categorizes income earners into four quadrants: Employee, Self-Employed, Business Owner, and Investor. This framework helps individuals understand their current financial position and the steps needed to move towards greater financial security.

The audiobook emphasizes the importance of shifting from the left side of the quadrant, where most people reside, to the right side, where financial freedom is achievable. Kiyosaki’s practical advice and real-life examples make complex financial concepts easy to grasp, inspiring listeners to take control of their financial future.

Unlocking The Secrets Of Wealth

Robert T. Kiyosaki’s audiobook, Rich Dad’s Cashflow Quadrant, is a guide to financial freedom. It helps listeners understand how to build wealth and achieve financial independence. The audiobook explains the different ways people earn money and how to shift from being an employee to becoming a business owner or investor.

The Philosophy Behind Cashflow Quadrant

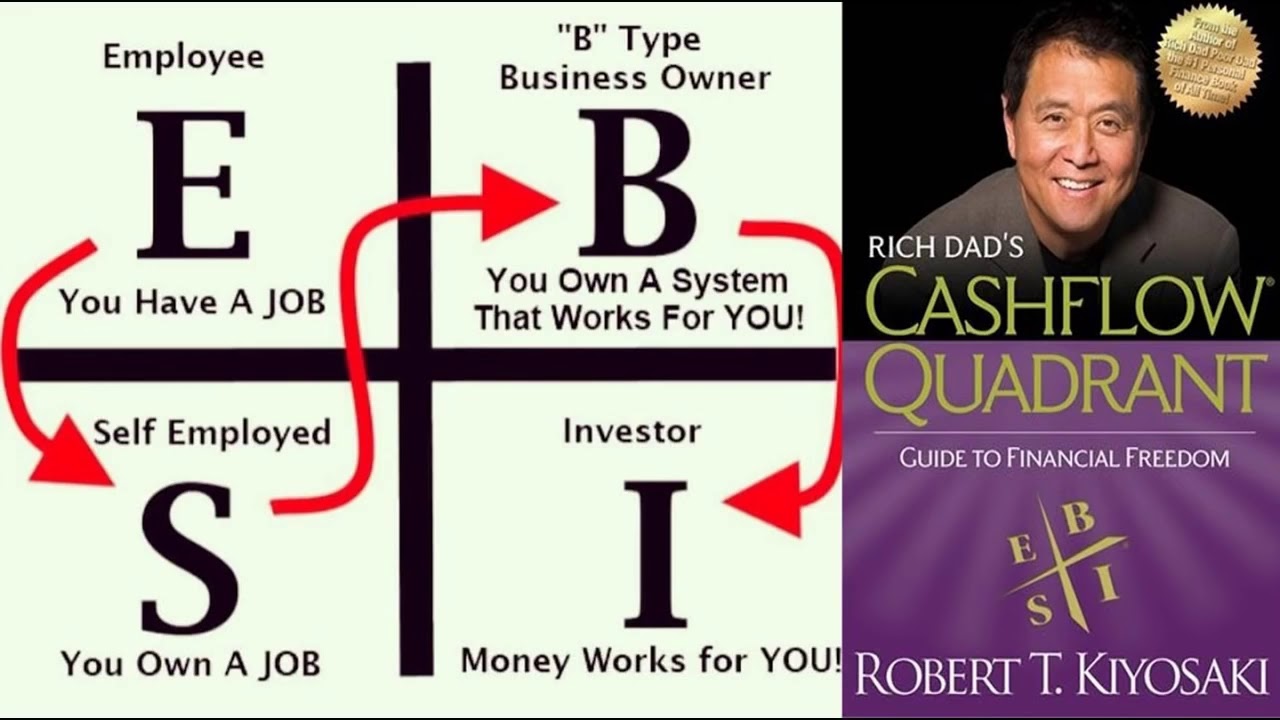

The Cashflow Quadrant is a concept that divides people into four categories based on their income source. These categories are:

- Employee (E) – Works for someone else

- Self-Employed (S) – Works for themselves

- Business Owner (B) – Owns a system or business

- Investor (I) – Invests money to create income

Kiyosaki explains that true wealth and financial freedom are achieved in the B and I quadrants. He encourages listeners to make the shift from E and S to B and I.

Kiyosaki’s Path To Financial Freedom

Kiyosaki shares his own journey from being an employee to becoming a successful business owner and investor. He emphasizes the importance of financial education and taking control of your financial future.

Here are some key steps he outlines:

- Understand the Cashflow Quadrant and identify your current position.

- Learn about financial statements and how money works.

- Invest in assets that generate passive income.

- Surround yourself with like-minded individuals and mentors.

Kiyosaki’s approach is practical and actionable, making it accessible to anyone willing to learn and take charge of their finances.

Exploring The Cashflow Quadrant

In Robert T. Kiyosaki’s audiobook, Rich Dad’s Cashflow Quadrant, he explores the four types of people who make up the world of business. These are the Employee, Self-Employed, Business Owner, and Investor. Understanding the differences between these quadrants helps you achieve financial freedom.

E And S: Employee And Self-employed

The Employee quadrant consists of people who work for someone else. They trade their time for money. They have job security but limited income potential. Employees usually receive a steady paycheck and benefits. Their income stops if they lose their job.

The Self-Employed quadrant includes people who work for themselves. They have more control over their work. They often earn more than employees but work longer hours. Self-employed individuals rely on their skills and time. Their income may vary.

| Employee | Self-Employed |

|---|---|

| Works for someone else | Works for themselves |

| Steady paycheck | Variable income |

| Limited income potential | Higher income potential |

B And I: Business Owner And Investor

The Business Owner quadrant is for those who own a business system. They do not have to be present to make money. Business owners leverage other people’s time and skills. They have the potential for high income. They also face the risks of running a business.

The Investor quadrant consists of people who make money work for them. Investors use their money to generate more money. They focus on building wealth. They have the highest potential for passive income. Investors need to understand financial markets and risks.

| Business Owner | Investor |

|---|---|

| Owns a business system | Makes money work for them |

| Leverages other people’s time | Focuses on building wealth |

| Potential for high income | Potential for passive income |

Understanding these quadrants can guide your financial journey. Decide where you want to be for achieving financial freedom.

Practical Steps To Shift Quadrants

Shifting from one quadrant to another can transform your financial future. Robert T. Kiyosaki’s audiobook, “Rich Dad’s Cashflow Quadrant,” outlines practical steps for this journey. This section will cover essential mindset changes and real-world strategies for wealth accumulation.

Mindset Changes And Financial Education

Changing your mindset is the first step in shifting quadrants. Understand that moving from the Employee (E) or Self-Employed (S) quadrants to the Business Owner (B) or Investor (I) quadrants requires a new way of thinking.

- Embrace Risk: Accept that risk is part of the journey. Learn to manage it.

- Seek Knowledge: Invest time in financial education. Read books, listen to audiobooks, and attend seminars.

- Network: Surround yourself with like-minded individuals. Join groups and forums that focus on business and investing.

Financial education is crucial for success. Learn the difference between assets and liabilities. Understand how to read financial statements. This knowledge will help you make informed decisions.

| Mindset Shift | Action |

|---|---|

| Embrace Risk | Start small with investments |

| Seek Knowledge | Read “Rich Dad’s Cashflow Quadrant” |

| Network | Join business forums |

Real-world Strategies For Wealth Accumulation

Applying real-world strategies is the next step. Focus on creating multiple income streams. This reduces dependency on a single source.

- Invest in Real Estate: Purchase rental properties. These provide passive income.

- Start a Business: Launch a small business. Aim to scale it over time.

- Stock Market: Invest in stocks and bonds. Diversify your portfolio.

Track your progress. Use financial tools and apps to monitor your investments. Regularly review and adjust your strategies. This ensures you stay on the right path.

Remember, the journey to financial freedom is ongoing. Stay committed and keep learning. Robert T. Kiyosaki’s insights can guide you every step of the way.

Conclusion

“Rich Dad’s Cashflow Quadrant Audiobook” offers valuable insights into financial independence. Kiyosaki’s principles can guide you towards financial freedom. By understanding different income sources, you can make informed decisions. This audiobook is a must-listen for anyone serious about improving their financial literacy.

Embrace these lessons to transform your financial future.